Modified by Simisola Fagbola, Econoday Economist

The Economic situation

Inflation

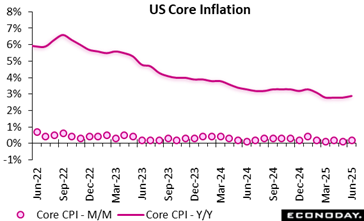

June’s cozy United States inflation data can be the begin of the anticipated inflationary impacts of higher tariffs (predicted to strike from mid- 2025 onwards). This will boost the Federal Reserve’s wait-and-see stance as it analyzes if this report does mark the beginning of a broad and sustained inflationary influence from the tolls.

The Consumer Price Index in June ramped up by +0. 3 percent, adhering to a 0. 1 percent increase in May, and a 0. 2 percent jump in April. The June CPI reviewing matches expectations for a 0. 3 percent increase in the Econoday survey of forecasters. This finishes the stagnation in the month-to-month rate of overall consumer cost inflation seen between February and May.

Over the last 12 months, customer costs are up 2 7 percent, contrasted to a 2 4 percent year-over-year rise in May. Assumptions in the Econoday survey were for a 2 6 percent boost.

Core CPI, leaving out food and energy costs, is up 0. 2 percent, after rising 0. 1 percent in May, and +0. 2 percent in April. Consumer costs less food and energy climbed 2 9 percent from June 2024, adhering to a 2 8 percent year-over-year rise in May, and as expected in the Econoday study.

After increasing by 0. 3 percent in May, shelter prices rose by 0. 2 percent in June (and are up 3 8 percent year-over-year). Food costs raised by 0. 3 percent, the very same rate as in May, with grocery store costs up 0. 3 percent last month, and dining establishment costs climbing 0. 4 percent.

Power costs rebounded by 0. 9 percent over the month, powered by a 1 percent rise in power along with fuel prices.

Energy costs are down 0. 8 percent year-over-year, adhering to a 3 5 percent slide for the 12 months finishing May. Food costs boosted by 3 percent compared to June 2024, complying with a 2 9 percent surge in May.

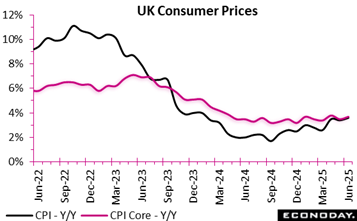

UK rising cost of living ticked upward in June 2025, mirroring relentless pressures across both goods and solutions. On an annual basis, heading rising cost of living sped up to 3 6 percent from 3 4 percent in May, while core CPI (stripping out volatile things) edged as much as 3 7 percent, signalling underlying inflationary energy continues to be solid. Goods inflation raised from 2.0 percent to 2 4 percent, driven by increasing fuel prices, while solutions inflation remained raised at 4 7 percent, underscoring the strength of domestic expense stress.

On the other hand, CPIH, that includes proprietor inhabitants’ real estate costs, rose by 4 1 percent year-over-year, up marginally from 4.0 percent, with the month-to-month gain of 0. 3 percent from 0. 2 percent reflecting broad-based boosts. Notably, core CPIH rose to 4 3 percent from 4 2 percent year-over-year, preserving its upward trajectory despite a minor alleviating in services inflation (from 5 3 percent to 5 2 percent). Transportation, especially electric motor fuel, was the primary upward chauffeur of both the CPI and CPIH, partially countered by slower development in housing-related prices.

Certainly, the most up to date updates recommend that the solution industry is the essential driver of inflation with a re-emergence of items inflation, complicating the Financial institution of England’s path to reducing. While headline prices might show up to secure, core signs disclose that cost pressures are still deeply rooted, recommending ongoing caution in monetary policy modifications.

Work

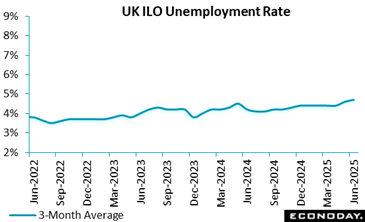

The UK labour market staff member numbers are continuously declining, with 135, 000 fewer workers in between May 2024 and May 2025, and an additional provisionary drop of 178, 000 by June 2025 over the year and 41, 000 on the month. This recession coincides with the 36 th successive quarterly autumn in openings, showing growing employer hesitancy in employing or replacing staff.

Despite this contraction, the employment price has a little improved to 75 2 percent, while unemployment has actually risen to 4 7 percent, suggesting a feasible lag between task losses and climbing . On the other hand, economic inactivity has actually edged to 21.0 percent, hinting at small work market re-engagement.

On pay, annual average incomes expanded by 5.0 percent, with real incomes also enhancing, 1 8 percent for regular pay and 1 7 percent for overall pay (CPI-adjusted). This reflects ongoing cost-of-living pressures however signals some durability in revenue growth. The general public sector surpassed the private sector in regular pay development (5 5 percent vs. 4 9 percent). Nevertheless, rising claimant counts and a sharp autumn in recruitment activity suggest underlying delicacy.

With 37, 000 functioning days lost to work disputes in May alone, commercial stress further complicate the expectation, stressing the need for cautious positive outlook in the middle of consistent volatility.

GDP

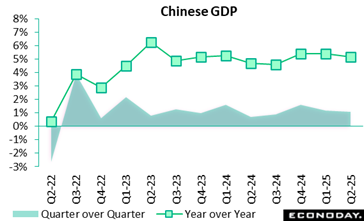

China’s GDP rose 1 1 percent on the quarter in the three months to June, bit transformed from growth of 1 2 percent in the three months to March, with year-over-year development alleviating from 5 4 percent to 5 2 percent. Month-to-month activity data also published today revealed solid growth in crucial activity indicators in June however an additional significant decline in residence prices.

In their statement accompanying today’s data, authorities characterised the data as showing the economy “stood up to stress and made consistent enhancement despite obstacles”. Although officials avoided clearly describing trade tensions with the USA, they kept in mind a requirement to “work with domestic economic work and endeavours in the international financial and trade area” and to “handle outside unpredictabilities”. Authorities repeated their commitment to “a lot more aggressive and efficient macro policies” but offered no particular guidance about whether added changes to policy settings will be thought about in the near-term.

Demand

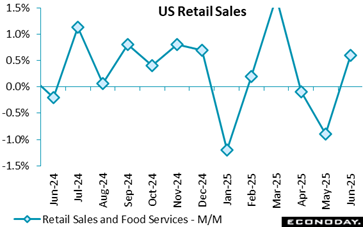

There was a stronger-than-expected recuperation in United States customer spending in June, although insufficient to balance out May’s decrease in intake. The underlying information, nevertheless, show enough resilience for Federal Reserve authorities to remain patient concerning the timing of the following rate cut.

United state June retail sales leapt by 0. 6 percent, partly recoiling from the unrevised 0. 9 percent monthly decline reported for May, and much greater than the +0. 1 percent consensus in the Econoday study of forecasters.

Core retail sales, eliminating autos and gasoline sales, likewise increased 0. 6 percent last month adhering to a revised flat analysis in May (previously reported as -0. 1 percent). Core retail sales are up 4 1 percent on an annual basis in June contrasted to a 4 6 percent y/y jump in May.

Auto sales increased 1 2 percent in June, not enough to remove May’s 3 8 percent decline, but is up 6 5 percent vs. in 2014. Task appears to be recuperating after decreasing complying with the pre-tariffs spike in March.

Summertime investing is strong, not robust, with building materials, yard equipment and vendors’ sales up 0. 9 percent in June, while restaurants and bars’ sales increased 0. 6 percent (and + 6 6 percent from June2024

E-commerce sales decreased to a 0. 4 percent rise in June from +0. 6 percent in May, and they are 4 5 percent more than a year earlier.

Compared to a year ago, June retail sales are up 3 9 percent, contrasted to May’s 3 3 percent dive.

Omitting gas, retail sales raised 0. 7 percent, falling after May’s 0. 8 percent decrease, and leapt 4 6 percent from June 2024 vs. + 4.0 percent on an annual basis in May.

Removing out purchases of motor vehicles and components, sales climbed 0. 5 percent contrasted to 0. 2 percent decline (previously -0. 3 percent) in May. On an annual basis, retail sales ex-autos are up 3 3 percent, a stagnation from May’s 3 6 percent speed.

Manufacturing

In May, United States commercial manufacturing rebounded by 1 7 percent over the month after a modified decrease of 2 2 percent in April. This rebirth was driven by surging need for non-durable consumer goods, which soared 8 5 percent month-over-month, recommending a change in house usage towards basics amidst sticking around economic uncertainty.

Energy manufacturing likewise saw a solid 3 7 percent uplift, reflecting feasible seasonal or supply-side shifts, while resources items increased by 2 7 percent, meaning renewed investment confidence. Nonetheless, the decline in intermediate goods (minus 1 7 percent) and resilient durable goods (minus 1 9 percent) recommends that some supply chain bottlenecks and consumer caution continue.

Year-over-year, the image is even more hopeful: overall commercial result jumped 3 7 percent contrasted to May 2024 Notably, non-durable consumer goods surged 11 6 percent, showing solid house durability. Capital goods adhered to with a 4 5 percent surge, potentially pointing to long-lasting economic positive outlook. Yet, the yearly autumn in intermediate items (minus 1 8 percent) might indicate structural concerns within manufacturing chains.

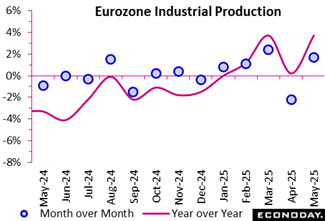

Regionally, commercial production on an annual basis increased in Germany (1 9 percent after minus 2 5 percent) and Spain (1 7 percent after 0. 4 percent), while it slightly increased in France (minus 1.0 percent after minus 1 5 percent) but stayed in negative territory for France. Nevertheless, it dropped in Italy (minus 0. 9 percent after 0. 1 percent) on a yearly basis.

Peremptorily, May’s information show that commercial production is recovering, with toughness in consumer essentials and investment signalling a stabilising commercial base in the euro area.

United States Evaluation

Fed’s Waller/Bowman: Signaling Fed Policy Shift?

By Theresa Sheehan, Econoday Economic Expert

On July 17, Fed Guv Christopher Waller clearly stated he would support a 25 basis point cut in the fed funds target variety at the July 29 – 30 FOMC conference. He placed his view within the existing readily available economic data and the expectation that inflation from tariffs would certainly result in “one-off rises in the cost level.”

Back on June 23, Vice Chair for Guidance Michelle Bowman stated she would favor a price reduced at the July FOMC meeting if rising cost of living pressures continued to be “included”.

Given that Both Waller and Bowman are appointees of the previous Trump administration, there will undoubtedly be a political context given to these views. Speculation concerning a power play within the Federal Book Board of Governors will certainly climb since Head of state Donald Trump is clearly planning to locate a method to get rid of existing Chair Jerome also as he pacifies markets with denials. Rifts among members of the board are likely due even more to sincere differences of opinion than political maneuvering, although it would certainly be ignorant to disregard it totally.

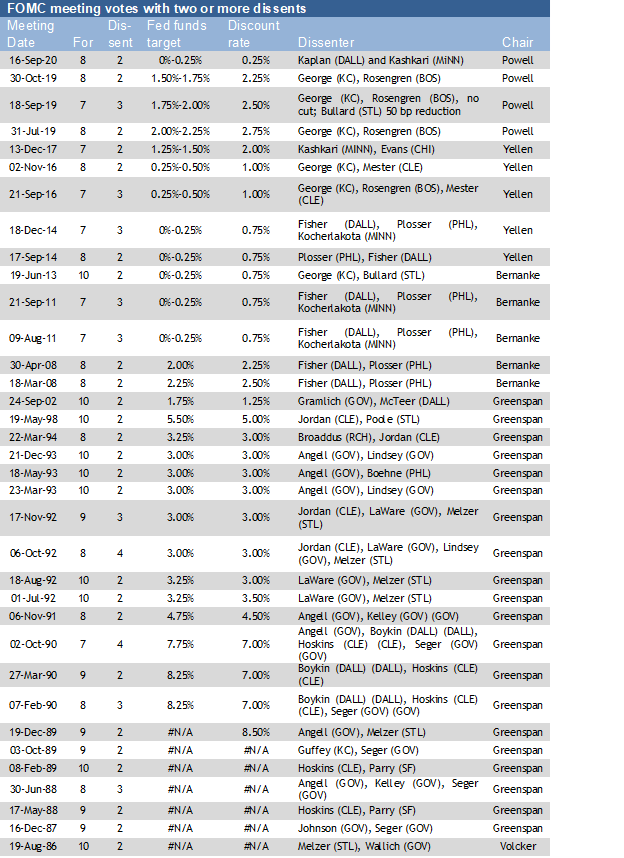

Regardless, this sets up the following meeting as abnormally contentious with the potential for a minimum of 2 dissents in the ballot. One dissent in the FOMC ballot is not that uncommon, however 2 or even more signal a bigger internal dispute. And the dissents are likely from the governors where generally it is the district bank presidents who dissent. The last time there was substantial opposition by governors to establishing limiting financial plan at a time of inflation was during the period of Paul Volcker.

Something the exact same might be occurring here from the “stress” in the dual mandate that Powell and various other have discussed lately. There are FOMC voters who will be concentrated on the weakening in the labor market and much less worried concerning a short-term increase in rising cost of living. There are FOMC citizens that will certainly focus on the reduced joblessness price and stress over enabling rising cost of living to become an issue once again together with increasing inflation assumptions for the longer-term.

An aberration of viewpoints on the FOMC that appears as a dissent is typically a signal of a shift in financial plan. The broader the aberration, the most likely it is that policy is moving toward a modification.