&# 13;

Miss to content

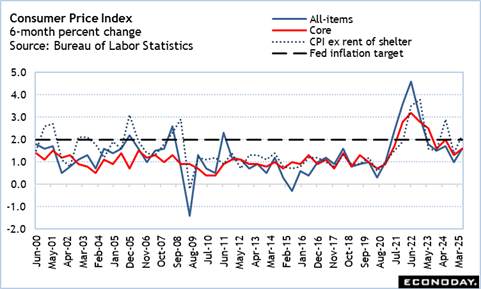

A consider the six-month percent modification in the CPI at the end of the 2nd half of 2025 firms up expectations that the FOMC won’t alter its mind about rising cost of living continuing to be “rather raised” as a factor to maintain the fed funds target rate variety at 4 25 – 4 50 percent.

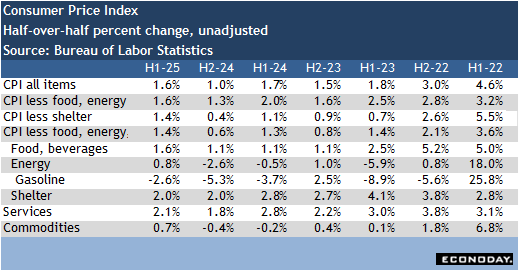

As a matter of fact, the speed of consumer rate increases grabbed significantly over the previous six months as total costs rose for both solutions and commodities. The index for services is up 2 1 percent in the very first fifty percent of 2025 compared to up 1 8 percent in the 2nd fifty percent of 2024 The index for products prices is up 0. 7 percent in the very first half of 2025 after down 0. 4 percent in the 2nd half of 2024 One more time consumer prices are extensively relocating far from the Fed’s 2 percent rising cost of living purpose, and not simply in non-housing services.

The six-month boost in the all-items CPI is 1 6 percent in the first half of 2025, up from 1.0 percent in the 2nd fifty percent of 2024 and virtually back to the 1 7 percent in the first half of 2024 The core CPI is up 1 6 percent in the initial fifty percent of 2025 compared to up 1 3 percent and up 2.0 percent in the 2nd and first fifty percent of 2024, respectively.

Power rates are up 0. 8 percent in the first fifty percent of 2025, although fuel rates are down 2 6 percent. Still, the energy consumer price index is up after 2 halves of declines of 2 6 percent and 0. 5 percent in the second and very first fifty percent of 2024, specifically. Moderation in food costs has ended. The food price index was up 1 1 percent in the prior 3 halves, but up 1 6 percent in the first fifty percent of 2025

The one brilliant spot may be that the consistent rate gains in shelter prices have started to level off. The index for shelter is up 2.0 percent in the initial fifty percent of 2024, the like in the 2nd half of 2024, and listed below the up 2 8 percent in the first fifty percent of 2024

Share This Story, Choose Your Platform!